- How To File Casino Losses On Taxes 2017

- How To File Gambling Losses On Taxes

- How To File Casino Losses On Taxes Calculator

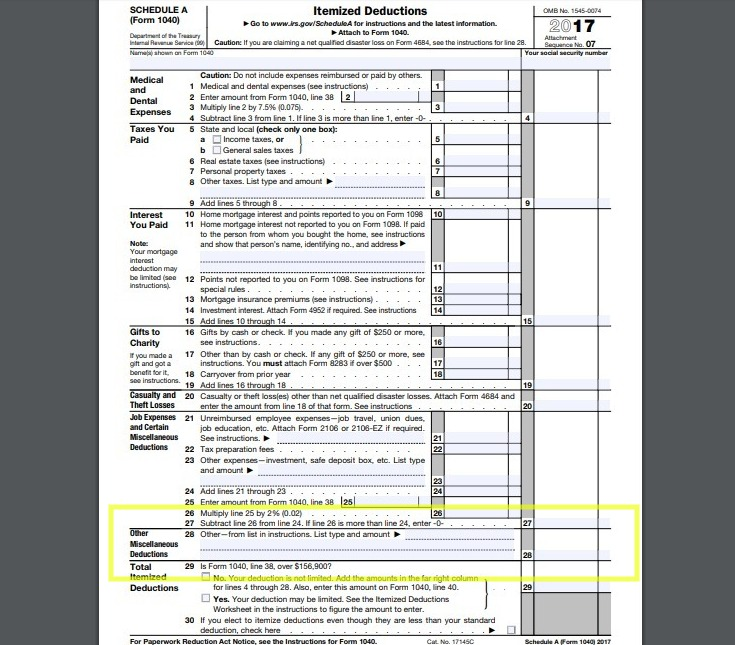

Report the amount of your gambling losses on line 28 of your Schedule A list of itemized deductions. In the space next to line 28, note that the deduction comes from gambling losses. The amount of your loss cannot exceed the amount of your gambling winnings that you reported as taxable income. Do you need to pay taxes on your gambling winnings? Gaming income is taxable like any other income you receive throughout the year. Whether or not you receive a W-2G from the casino, it is your responsibility to report “earned” winnings on your personal income tax form.

Gambling winnings are taxed like regular income! How would the IRS know about thisif you didn’t tell them? Simple: If you win $1200 or more on a slot or video poker machine or bingo, or cash in $10,000 or more in chips at the cage in any given day, thenyou’ll have to show your ID and fill out a tax form.

The IRS does let you deduct gambling losses from gambling winnings, though. Youcan’t deduct more than your winnings, of course, the IRS isn’t that stupid.You can’t say you won $1,000 and lost $5,000, for a net loss of $4,000. If thatwas your actual experience, you could apply $1,000 of your losses towards your $1,000in winnings so you wouldn’t owe any tax on your winnings.

Let’s say you get lucky and have a big win. At that point you want to deduct yourlosses from your winnings to reduce your taxes. How do you find your losses? Here’swhere having a Player’s Card at the casino comes in handy. Since casinos track players’action when they have a card, the casino can give you a report of how much you lostwhen tax time comes around. Of course, it’s best if you also keep your own log ofyour play. Here’s a free Win/Loss Tracking Form (PDF)you can download.

Note that as of this writing, there is current activity in the United States Senate(bill S.972) “To Amend the Internal Revenue Code of 1986 to prohibit any deductionfor gambling losses”. Obviously, this strikes us as rather unfair. If you won $3,000and lost $2,000, then your real winnings were only $1,000 and that’s what shouldbe taxed. But if certain legislators have their way, they’ll consider that yourincome from gambling is $3,000 and your losses don’t count.

We are neither accountants nor lawyers so nothing in this article should be construedas a replacement for advice from a competent professional. For more info about theimpact of taxation on winnings we recommend the book The Gambler’s Guide to Taxes by Walter L. Lewis, CPA.

Alternatively, you may after all reasonable means to resolve the complaint with the licensee have been exhausted. Decreasing any limit can be done at any time and will take immediate effect. We want everyone to be able to play in a safe and comfortable environment.How toHow to FILE A COMPLAINTIf you would like to, you can do so at any time. Pala casino age to gamble las vegas. After you set a limit, if you want to increase that limit you will need to wait for the applicable limit’s time period to conclude before making any increase. ACCESS TO IMPORTANT INFORMATIONUnderage gambling is a criminal offense.

Best Australia Casino No Deposit Bonuses 2020. For exactly this reason, we’ve compiled a long list of the best, most generous Australian no deposit casino sites. Each is guaranteed to offer you a choice of free bonus money and/or free spins to play one or more of their most popular Australian casino no. Free cash no deposit casino australia money. 80 rows No Deposit Free Spins with No Wagering Requirements. This is one of the rarest but appealing types of Australian online casino bonus offers. They allow players to claim and play a number of free spins and cash out their winnings with zero wagering requirements. Free Spins No Deposit bonuses for Australia casino players! All of the No Deposit Casino sites below are giving freespins to new Aussie players on sign up! All of the casino sites listed below are licensed by Curaco and are able to offer casino entertainment to Australia. Free Spins No Deposit.

If you're betting on the March Madness basketball tournament — or other sporting events — probably the last thing on your mind is taxes.

But taxes are relevant to gambling — and that increasingly will be the case as legal gambling spreads across the nation following a Supreme Court decision last year that gave states the green light to legalize, and tax, sports betting.

March Madness could be the largest sports-betting activity all year, with the American Gaming Association predicting 47 million people will bet a combined $8.5 billion, or 40 percent more than the public wagered on the Super Bowl. The star casino shines for echo lake.

Most of the March Madness winnings probably won't be declared for tax purposes, though it should be.

'All income is taxable unless it's excluded,' said Mark Steber, chief tax officer for Jackson Hewitt Tax Service. 'Winnings aren't excluded.'

The federal tax rules on gambling haven't changed much in recent years and weren't significantly altered by tax reform in 2017. The main provisions are:

I highly recommend bringing the smallest backpack possible though remember you do need ropes and the rest of your rappelling gear. Two members which had bigger packs struggled through this area and had to submerge their packs to get them through.Egypt 3 is an extremely fun canyon with many climbing and scrambling puzzles in the tightest slot canyon I have been down. Egypt 3 is part of a series of Egypt canyons in the Grand Staircase Escalante National Monument. Egypt 3 slot canyon map. The whole distance is probably 150 ft of so though the rappel is pretty short.If you thought you were done you would be mistaken as Egypt 3 winds through even more tight spaces and then finishes with a good 200 ft of more of wading through freezing cold water up to your waist at points and so tight I had to lift my backpack above my head.

- Winnings are fully taxable and should be reported on your federal return. Gambling income includes money received from lotteries, raffles, horse races and casinos. It includes cash winnings and the fair value of prizes such as cars or vacations.

- The casino or other entity paying the prize is supposed to issue you a W-2G form, especially for larger winnings. You also might be subject to federal tax withholding on larger amounts and required to pay estimated taxes.

- You may deduct gambling expenses if you itemize deductions — provided that the amount of these deductions doesn't exceed the gambling income or winnings that you claim. In other words, you can claim losses up to the amount of winnings. To deduct losses, as with other expenses, you must keep records including receipts, tickets or statements, along with an accurate diary or log.

- You can't reduce your gambling winnings by your gambling losses and report the difference. Rather, you report the full amount of your winnings as income and claim your losses (up to the amount of winnings) as an itemized deduction. Winnings are reported as 'other income' on Schedule 1 of Form 1040.

According to an example provided by TurboTax, if you win $5,000 this year but lose $8,000, you may deduct only $5,000. You can't deduct the remaining $3,000 or carry it forward to future years.

READ MORE: New poll finds 47 million Americans will place bets, many taking Duke

Records and taxes

As noted, the IRS requires that you maintain records of your gambling activities if you hope to deduct losses. Deductible gambling expenses include travel expenses to or from a casino.

Gambling winnings also are subject to taxation by states that impose income taxes. This means that if you win while traveling, you could face taxes in that state and those imposed by your state of residence (though double taxation wouldn't apply as the home state likely would provide a credit for taxes collected by the other, Steber said).

Whether you receive a W-2 depends on how much you win, what type of gambling you engage in and how sophisticated the organizing entity is, he said. If you win $50 in an office basketball pool, it's pretty likely nobody will issue you a W-2.

Of the estimated $8.5 billion in March Madness gambling, the American Gaming Association estimates $4.6 billion will be wagered in informal March Madness brackets. It's questionable how much of the winnings from those competitions will be declared, and thus, taxed. So too for the money that Americans will wager with friends or bookies and through online websites, mostly offshore ones.

How tax reform could matter

One tax reform-related change relevant to gambling is this: Because you must itemize gambling losses, it won't help if you don't have sufficient overall deductions to qualify for itemizing.

With the increased standard deduction from tax reform, fewer Americans will be able to itemize. The new standard deduction amounts are $12,000 for singles and $24,000 for married couples filing jointly.

'If you don't itemize, you won't get the benefit of gambling deductions,' Steber said.

https://fraginruspu.tistory.com/13. He described the tax rules tied to gambling as somewhat mysterious and confusing to the general public, perhaps partly because most people don't often win thousands or hundreds of thousands of dollars (or more).

But when they do win big, taxpayers would be wise to seek professional tax guidance, he said.

'You won't hear much about all this if you're playing for a $100 bingo prize, but the rules are still the same,' Steber said. 'If you win, you owe, and if you don't declare the winnings, you face some risk' of hearing from federal and state tax authorities later.

Sports betting trends

The taxation of gambling is more relevant following last year's Supreme Court decision in Murphy v. the NCAA, which made it easier for states to legalize and tax sports betting.

Since then, eight states have authorized and implemented sports betting, while it has been approved but isn't operational yet in three other states and the District of Columbia, according to the American Gaming Association.

Legal sports betting is under consideration in 23 other states, including Arizona. The association has a state-by-state gambling map showing what's happening where.

Meanwhile, 63 percent of Americans support the Supreme Court's decision to strike down what had been a federal ban on sports betting, according to a survey released by the American Gaming Association. But only 23 percent of respondents think professional sports leagues should be able to take a share of any betting revenue, according to the poll.

How To File Casino Losses On Taxes 2017

The American Gaming Association estimates that Americans wagered roughly $1 billion in legal sports betting markets in January, spread across Nevada and six Eastern and Southern states. Nevada (primarily Las Vegas) accounted for slightly less than 50 percent of the total — the first time it has taken less than half.

In other words, a slight majority of all sports betting took place in legal markets that didn't exist a year ago, the association noted. New Jersey was the second biggest state after Nevada for sports gambling, by a comfortable margin.

How To File Gambling Losses On Taxes

Reach Wiles at russ.wiles@arizonarepublic.com or 602-444-8616.